The Internal Revenue Service (IRS) provides draft instructions for Form 8958 to guide filers through its necessary components. This form primarily focuses on reporting foreign financial assets and accounts requiring specific details. Understanding its key sections ensures transparency, accuracy, and compliance with tax regulations. Filers must adhere to these instructions to avoid penalties and ensure timely submission.

Purpose and Overview of Form 8958

Form 8958 is designed to ensure compliance with U.S. tax regulations related to foreign financial assets. Its primary purpose is to identify individuals and entities holding interests in specified foreign financial accounts or entities. The IRS issues draft instructions to guide filers in completing this form accurately. Filers must report information about foreign trusts, corporations, partnerships, and financial accounts to maintain transparency and accountability. Understanding the form’s requirements is essential for meeting legal obligations and avoiding penalties. The instructions emphasize the importance of timely submission and accuracy in reporting. By adhering to these guidelines, filers can ensure compliance with U.S. tax laws and avoid potential issues. This form plays a critical role in the U.S. government’s efforts to combat offshore tax evasion and promote tax fairness. For those eligible, completing Form 8958 may also qualify them for streamlined filing procedures.

Key Sections and Requirements

Form 8958 requires careful attention to its core sections to ensure compliance with IRS guidelines. The form is divided into sections that detail specific information about foreign financial assets, including accounts, trusts, corporations, and partnerships. Key requirements include identifying the types of accounts reported, providing detailed ownership information, and stating the maximum value of these assets during the tax year. Filers must also report transactions with foreign entities and disclose any previously undisclosed accounts. The IRS provides draft instructions to guide filers in completing each section accurately. Adhering to these guidelines ensures transparency, compliance, and avoidance of penalties. Proper completion of Form 8958 is essential for maintaining good standing with the IRS and fulfilling legal obligations under U.S. tax law.

Types of Accounts Covered by Form 8958

Form 8958 requires detailed reporting of foreign financial accounts and certain foreign entities. The types of accounts covered include foreign financial institutions, such as banks, brokerage firms, and trusts. Additionally, it includes accounts in foreign corporations, partnerships, and other foreign entities. Individuals must report accounts with a maximum value exceeding specified thresholds, even if they do not hold a direct ownership stake. The form also covers retirement accounts and insurance policies held outside the United States. This section ensures transparency and compliance with international tax regulations. Proper reporting of these accounts helps prevent discrepancies and potential penalties. By accurately identifying and listing all required accounts, filers demonstrate adherence to IRS guidelines and legal obligations. The IRS provides draft instructions to assist taxpayers in completing this section correctly and thoroughly.

Understanding the Instructions for Form 8958

Understanding the instructions for Form 8958 is essential for accurate reporting of foreign financial assets and accounts. This includes thresholds, ownership stakes, and compliance with IRS guidelines to avoid penalties.

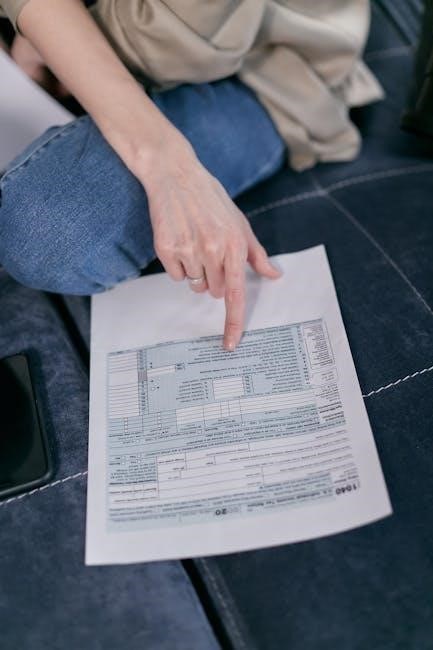

Step-by-Step Guide to Completing Form 8958

Completing Form 8958 requires careful attention to its structured sections. Begin by reviewing the filing requirements to ensure eligibility and understanding thresholds for foreign financial assets. Identify all relevant foreign accounts, including their types, account numbers, and balances. Accurately report the total value of these assets as of the tax year end. Detail ownership percentages for each account, specifying whether they fall under direct or indirect control. Clearly explain any exceptions or special circumstances. Review instructions for proper filming methods, whether electronic or paper, and include all required supporting documents. Double-check all figures for consistency and accuracy to avoid penalties. Finally, ensure all signatories have reviewed and approved the form before submission. This structured approach ensures compliance with IRS guidelines and minimizes errors.

Common Scenarios and Filing Requirements

Form 8958 is required when an individual’s foreign financial assets exceed specified thresholds, such as $50,000 at year-end for single filers. Scenarios include holding foreign bank accounts, mutual funds, or ownership in foreign entities. Filing requirements demand detailed reporting of foreign accounts, including account types, numbers, and balances; You must provide the aggregate value of your foreign assets, specify ownership percentages, and attach required documentation. Ensure accurate reporting to avoid penalties. Consulting a tax professional is advisable for compliance. Proper completion and submission are crucial to avoid hefty fines. Stay informed and stay compliant with Form 8958 requirements.

Special Considerations for Foreign Financial Institutions

Foreign financial institutions (FFIs) must treat Form 8958 with particular care under IRS guidelines. First, FFIs are required to implement robust due diligence procedures to identify U.S. account holders accurately. Second, they must ensure proper reporting of all relevant account details, including ownership percentages and account values. Third, FFIs should maintain thorough documentation to meet compliance standards. Additionally, FFIs may need to collaborate with U.S. tax authorities and comply with FATCA regulations, which often overlap with Form 8958 requirements. Understanding these responsibilities helps FFIs avoid penalties and maintain positive business relationships. Staying informed about IRS updates is essential for seamless compliance. A proactive approach ensures accurate reporting and minimizes the risk of non-compliance issues. By adhering to these guidelines, FFIs can fulfill their obligations effectively and efficiently.

Filing Requirements and Deadlines

Form 8958 must be filed by individuals with specified foreign financial assets exceeding thresholds. The deadline aligns with tax filing deadlines, typically April 15th, unless extended. Penalties apply for late or incorrect filings, emphasizing the need for accurate documentation and timely submission. Proper review of instructions ensures compliance with IRS guidelines.

Who Needs to File Form 8958?

Individuals required to file Form 8958 include those holding specified foreign financial assets with a total value exceeding certain thresholds. Specifically, this applies to U.S. citizens and residents with foreign accounts or financial interests valued over $50,000 at year-end. For others, the threshold is $25,000 on any day during the year. These assets may include foreign bank accounts, stocks, bonds, or other financial instruments under specified foreign financial institutions. Failure to file despite meeting these criteria can result in significant penalties. Proper understanding of filing requirements and timely submission ensures compliance with IRS regulations. When in doubt, consulting a tax professional or referring to official IRS resources is advisable.

Deadline for Submitting Form 8958

The IRS sets a specific deadline for submitting Form 8958, typically aligning with other tax-related filings. For most filers, the deadline is April 15th of the year following the tax year being reported. However, this may vary slightly depending on weekends or holidays. Those requesting an extension must submit the form by October 15th to avoid penalties. Ensure accuracy and timeliness when filing to avoid disruptions or financial penalties. Properly organizing records and adhering to the deadline guarantees compliance with IRS regulations. Delays or omissions can result in severe consequences, including fines; Deadlines also apply to foreign financial institutions, emphasizing the importance of strict adherence for all parties involved. Staying informed about the latest updates ensures smooth submission and avoids unnecessary complications.

Penalties for Late or Incomplete Filings

Failing to file Form 8958 or submitting it incomplete can result in significant penalties under IRS guidelines. The penalties may include failure-to-file fines, accuracy-related penalties for incorrect or omitted information, and potential ricochet effects on other related tax returns. The penalties escalate with the duration of the delay, emphasizing the importance of timely and accurate submissions. Penalties may also apply to foreign financial institutions that fail to comply with specific reporting requirements. Understanding the penalties and adhering to the instructions helps ensure compliance and avoids unnecessary financial consequences. Awareness of these penalties underscores the need for careful preparation and timely filing to maintain compliance with IRS regulations. Delays or inaccuracies can lead to prolonged scrutiny, financial penalties, and reputational damage, underscoring the importance of adherence to all stipulated guidelines.

Examples and Templates

Examples and templates for Form 8958 are essential tools for filers to navigate its requirements. These aids simplify reporting and highlight key details. Sample forms serve as guides, ensuring accurate completion. Avoiding common mistakes is crucial for compliance and avoiding penalties. Reliable resources, such as those from the IRS, provide clarity and assistance for filers.lfw

Sample Form 8958 to Guide You

Sample Form 8958 provides a clear template to help filers understand and complete the form accurately. It highlights essential sections, such as foreign financial accounts and the information required for each. Reviewing a sample form ensures you include all necessary details, such as account numbers, balances, and ownership percentages. It also helps you identify common mistakes to avoid, such as omitting required signatures or failing to report threshold amounts. By following the sample, filers can ensure compliance with IRS guidelines and avoid penalties. Use it as a reference to guide you through each step of the filing process, ensuring your submission meets all legal and regulatory standards.

Common Mistakes to Avoid When Filing

Filers of Form 8958 must carefully avoid common mistakes to ensure compliance and accuracy. One frequent error is failing to report all foreign financial accounts, even those with minimal balances. Missing deadlines or submitting incomplete forms can result in penalties and delays. Another common issue is incorrectly calculating the value of foreign assets or failing to provide accurate account details, such as account numbers or ownership percentages. Properly completing and signing the form is essential to avoid rejection. Additionally, overlooking specific filing requirements for certain types of accounts or foreign financial institutions can lead to noncompliance. By following the IRS instructions closely and double-checking all information, filers can minimize errors and ensure a smooth filing process.

Where to Find Additional Help and Resources

For guidance on completing Form 8958, the IRS provides comprehensive instructions and resources on its official website, including FAQs, publications, and sample forms. Additionally, professional tax preparers, CPAs, and tax attorneys specializing in international taxes can offer expert advice tailored to individual circumstances. Online forums and communities for expats or taxpayers with foreign accounts frequently discuss common challenges and best practices. The IRS website also includes a tax professional directory and taxpayer advocate assistance for those needing further support. By utilizing these resources, filers can ensure they meet all requirements and avoid complications during the filing process.

Adhering to the instructions for Form 8958 is crucial for accurate and timely filing. Review all requirements carefully to ensure compliance and avoid penalties. Seek professional advice if needed, and refer to IRS resources for further guidance. Proper attention to details will help maintain transparency and accountability in your tax reporting.

Reviewing the draft instructions for Form 8958, it is clear that this form focuses on reporting foreign financial assets and accounts. Key points include identifying the individuals and entities required to file, understanding the specific thresholds for reporting, and accurately detailing foreign financial accounts. The form emphasizes transparency and compliance with IRS regulations to ensure proper reporting of balances, transactions, and income. Failing to meet deadlines or provide accurate information can result in penalties and legal consequences. Understanding these requirements is essential for maintaining compliance and avoiding complications with the IRS. Seek professional guidance if needed to ensure accuracy and adherence to all stipulations.

Final Tips for Accurate Filing

When filing Form 8958, carefully review the IRS draft instructions to ensure accuracy and compliance. Double-check all account details, including balances, transactions, and income. Verify that all required thresholds for reporting foreign financial assets are met. Provide accurate information about foreign financial institutions and account holders. File by the deadline to avoid penalties. Seek professional advice if unsure about complex requirements. Maintain copies of all records for future reference. Compliance protects against legal issues and ensures smooth filing processes. Remaining diligent throughout the filing process is essential for accuracy and adherence to IRS guidelines.

Penalties for Non-Compliance with Form 8958

Failure to comply with Form 8958 requirements can result in significant penalties. The IRS imposes civil fines for non-filing or incomplete filing, with penalties increasing based on the length of delay. Additionally, criminal charges may be filed for willful non-compliance. Penalties for inaccurate or fraudulent reporting include substantial monetary fines and potential imprisonment. Timely and accurate filing of Form 8958 is crucial to avoid these consequences. Properly reporting foreign financial assets ensures adherence to tax regulations and protects against legal and financial repercussions. Always consult professionals to ensure compliance and avoid penalties associated with non-filing or incorrect submissions.